As Nigeria begins the implementation of the 2025 Nigeria Tax Act (NTA), the Dean, Faculty of Law, University of Lagos and Occupier, Lagos State Professorial Chair in Tax and Fiscal Matters, Professor Abiola Sanni, SAN, has advocated for constitutional legitimacy, clarity on roles peculiar to relevant institutions and genuine intergovernmental cooperation to ensure the effectiveness of the new tax law.

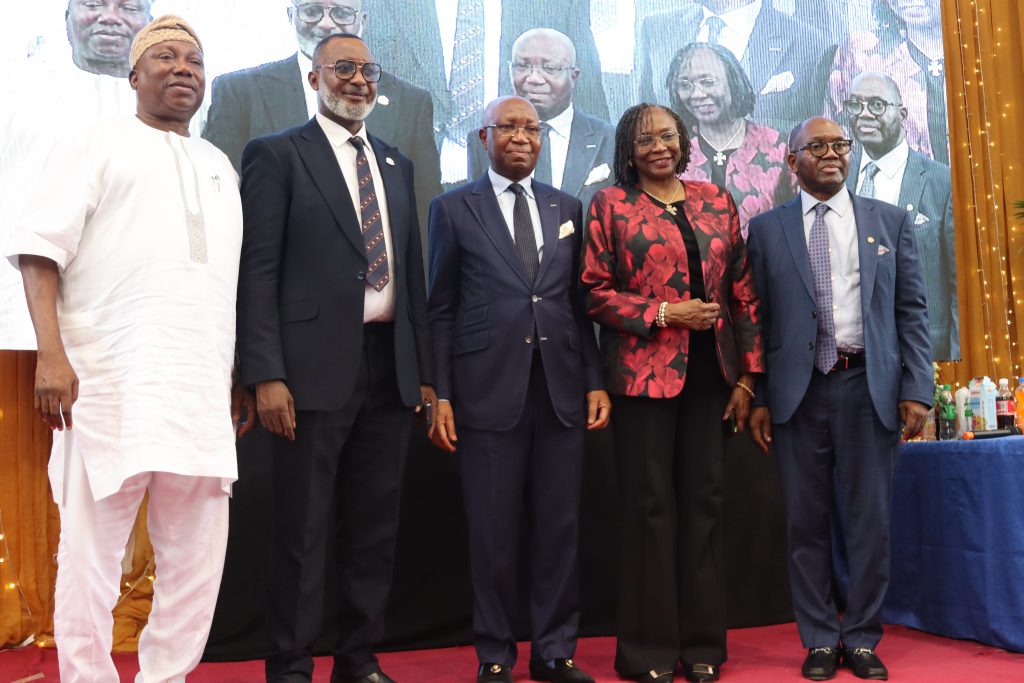

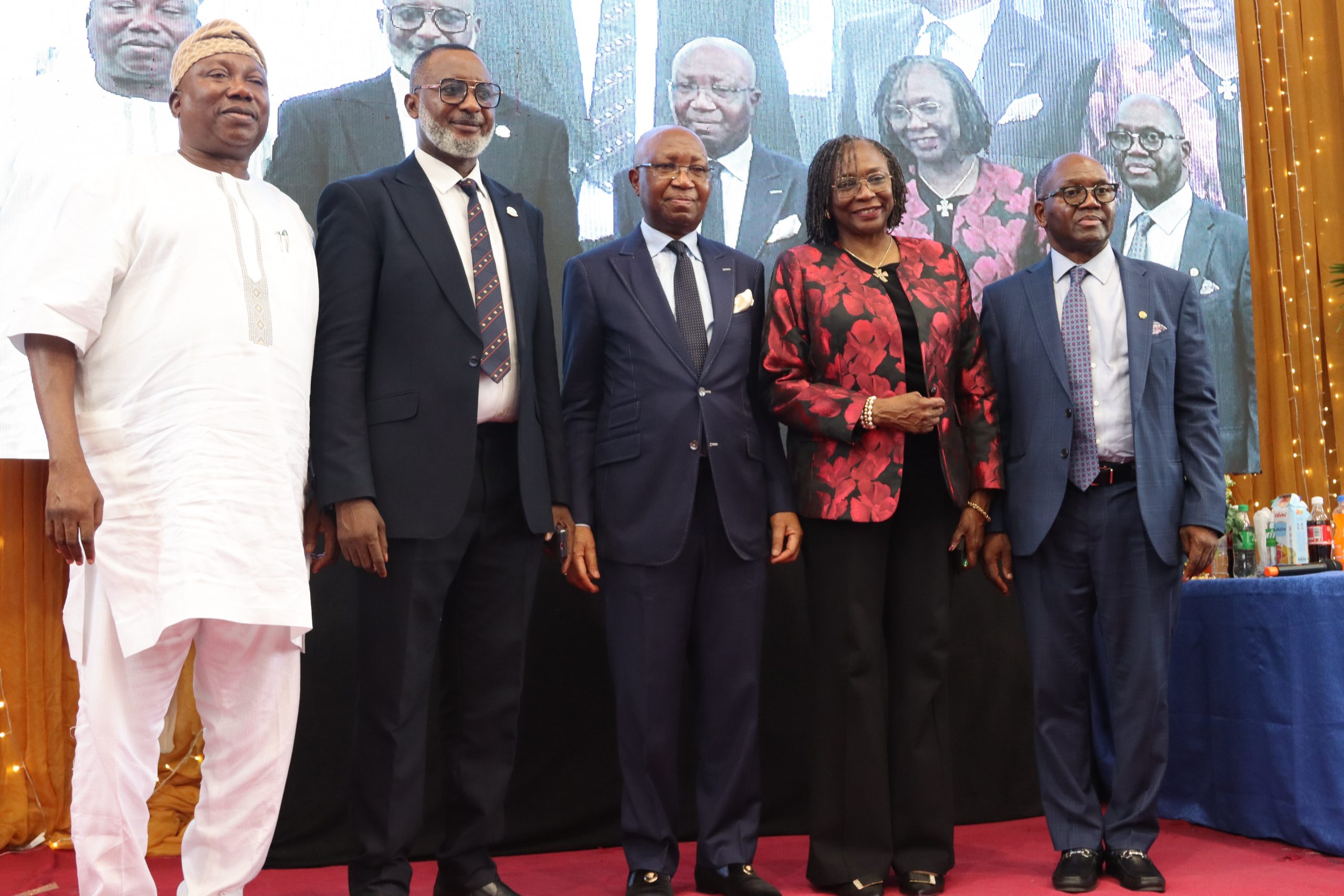

He stated this on Tuesday, January 27, 2026, while delivering the 2026 Lagos State Professorial Chair in Tax and Fiscal Matters Public Lecture at the Tayo Aderinokun Hall of UNILAG.

…the Lecture…

Titled Navigating Nigeria’s Tax Reform: Implication for Physical Federalism and State Autonomy, the public lecture drew stakeholders across critical public and private sectors of the society.

Prof. Sanni took time to give an evaluation of the new tax reform framework from the perspectives of fiscal federalism, constitutional structure and institutional design.

He applauded President Bola Tinubu for demonstrating the needed political will to see the tax reform through by directing the National Assembly to issue a Certified True Copy (CTC) of the 2025 Nigeria Tax Act (NTA) as passed by both chambers of the National Assembly and to oversee its re-gazetting against the backdrop of claims of discrepancy between the version earlier passed and the one gazetted.

The Professor of Commercial Law spoke exhaustively on a wide range of legal issues affecting Fiscal Federalism and the need to institute a governance structure which guarantees equity in resource allocation across all tiers.

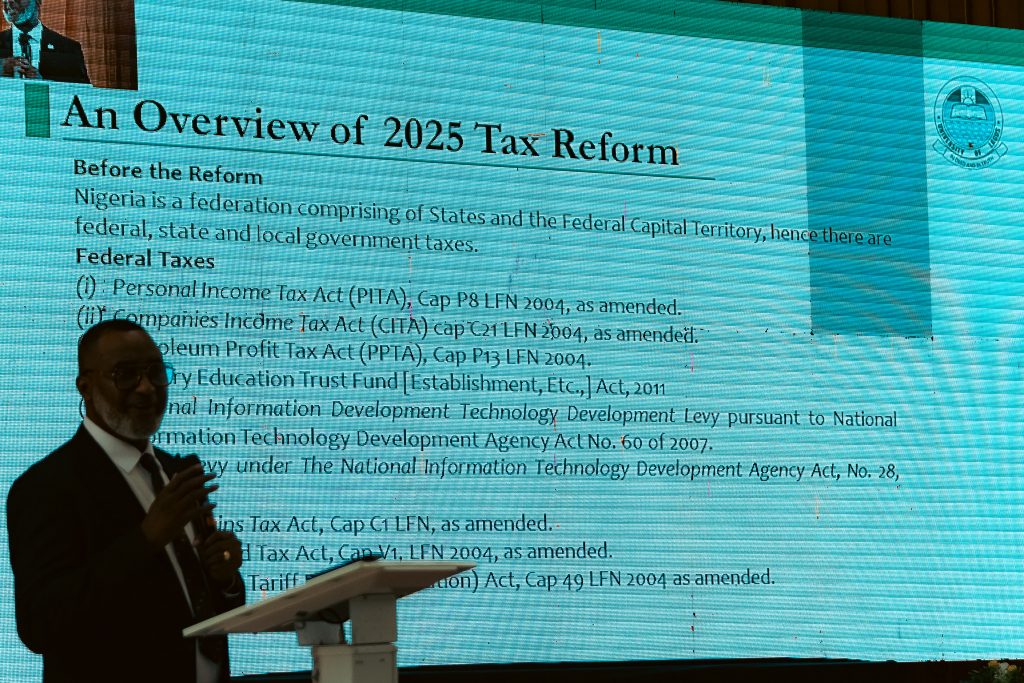

Prof. Sanni gave a detailed overview of some existing State and Federal Tax Laws vis-a-vis Nigeria’s unfolding fiscal framework, some unresolved issues involving Value Added Tax (VAT) and the constitutional limitations to the Federal Government’s powers as backed by the 1999 Constitution (as amended), legal jurisdictions over tax matters alongside other sundry matters relating to the establishment of Internal Revenue Collection institutions for States and Local Governments.

Recommendations…

Prof. Abiola Sanni adjudged the 2025 Nigeria Tax Act (NTA) a watershed in view of its scope and the groundbreaking reforms it brings into the country’s tax system.

He therefore challenged governments at all levels to commit to deepening education and public enlightenment on the 2025 Nigeria Tax Act (NTA).

Prof. Sanni also challenged state governments to formulate policies and enact laws which will guarantee fiscal sustainability.

…Special Guest of Honour and Professorial Chair Endower…

In his remarks, the Special Guest of Honour, Governor of Lagos State, Mr. Babajide Sanwo-Olu, represented by the Chairman, Lagos State Internal Revenue Services, Mr Ayodele , described the 2025 Nigeria Tax Act (NTA) as one signaling a stronger, fairer and more sustainable tax system for all Nigerians.

According to him, government is keen on fostering trust and accountability between every tax payer and the government while making the tax system more appealing and none-burdensome for everyone.

While applauding the UNILAG Management for the foresight and in-depth management of the Professorial Chair in Tax and Fiscal Matters since its inauguration, the Governor reiterated the state government’s keen commitment to the tax reforms by improving tax administration, expanding internal revenue base and ensuring optimization of every public resources to deliver public services that meets the needs of the masses.

…Remarks from Dignitaries…

In his remarks, the Lagos State Commissioner for Tertiary Education, Honourable Tolani Sule specially commended the Board of Trustees of the Lagos State Professorial Chair in Tax and Fiscal Matters headed by Professor Oluwayemisi Obashoro-John, the UNILAG Management and all stakeholders for ensuring that the Professorial Chair lives to its mandate of driving meaningful research and recommending far reaching reforms in the Lagos State Tax system.

Hon. Sule described the public lecture as a reminder of the importance of universities as indispensable allies in research and knowledge generation to guide public policy formulation and implementation. He assured of the Lagos State Government’s commitment to continually invest in education to drive social mobility, economic resilience, national transformation and bridge the gap between theories and practice.

There were also remarks by the Pro-Chancellor and Chairman, Governing Council of the University of Lagos; Chief Wole Olanipekun, SAN, as well as the Vice-Chancellor, Professor Folasade Ogunsola, OON, FAS.

They both described the public lecture as part of UNILAG’s offerings to deepen public knowledge about tax economy, innovation and sustainability.

While applauding Prof. Sanni for being a trail blazer from his faculty, Chief Olanipekun and Prof Ogunsola reiterated UNILAG’s stake as a space where critical national conversations are not only encouraged but are also anchored on research, comparative insights and intellectual independence.

Prof Ogunsola particularly called for further investments in professorial chairs and researches which would aid the interrogation of various issues of national importance.

Being the third in it series, the Lagos State Professorial Chair in Tax and Fiscal Matters Public Lecture according to the Chairman, Board of Trustees, Professor Oluwayemisi Obashoro-John, has lived up to its billing through recommendations on reforming tax policies and promoting fiscal federalism in Lagos and nationally.

Prof Obashoro-John, represented by the Head, Department of Commercial and Industrial Law and the University Orator, Professor Adewale Olawoyin, SAN, appealed to the Lagos State Government to commit to the sustenance of the professorial chair especially in view of its far-reaching research recommendations since its inauguration.

Report: Gbenga Gbelee

Photography: Olawale Fagbulu & Favour Megwara